QuantVantage.ai's marquee strategy that has outperformed every other long-term strategy available to retail traders to our knowledge. If you come across any external long-term strategy with a similar risk profile that has outperformed GenAlpha, please let us know and we will send you a token of appreciation. This strategy trades leveraged ETFs such as TQQQ.

Backtested Performance Metrics

GenAlpha vs. S&P 500/Nasdaq-100

Jan 1, 2019 to Oct 31, 2025

*SPY is the SPDR S&P 500 ETF Trust, which tracks the S&P 500 index | QQQ is the Invesco QQQ Trust, which tracks the Nasdaq-100 Index

GenAlpha Annual Returns vs. Benchmarks (SPY & QQQ)

SPY ETF tracks S&P 500 index | QQQ ETF tracks Nasdaq-100 Index

*2025 performance is hypothetical YTD as of September 30th, 2025. Past performance does not guarantee future results.

Performance Data & Analysis

Detailed historical performance metrics and investment growth analysis.

Hypothetical Investment Growth

Growth of $10,000 invested in SPY, QQQ, or GenAlpha.

*2025 performance is hypothetical YTD as of September 30th, 2025. Past performance does not guarantee future results.

Annual Performance vs. Benchmarks

Year-over-year returns comparison.

*2025 performance is hypothetical YTD as of September 30th, 2025. Past performance does not guarantee future results.

GenAlpha Performance

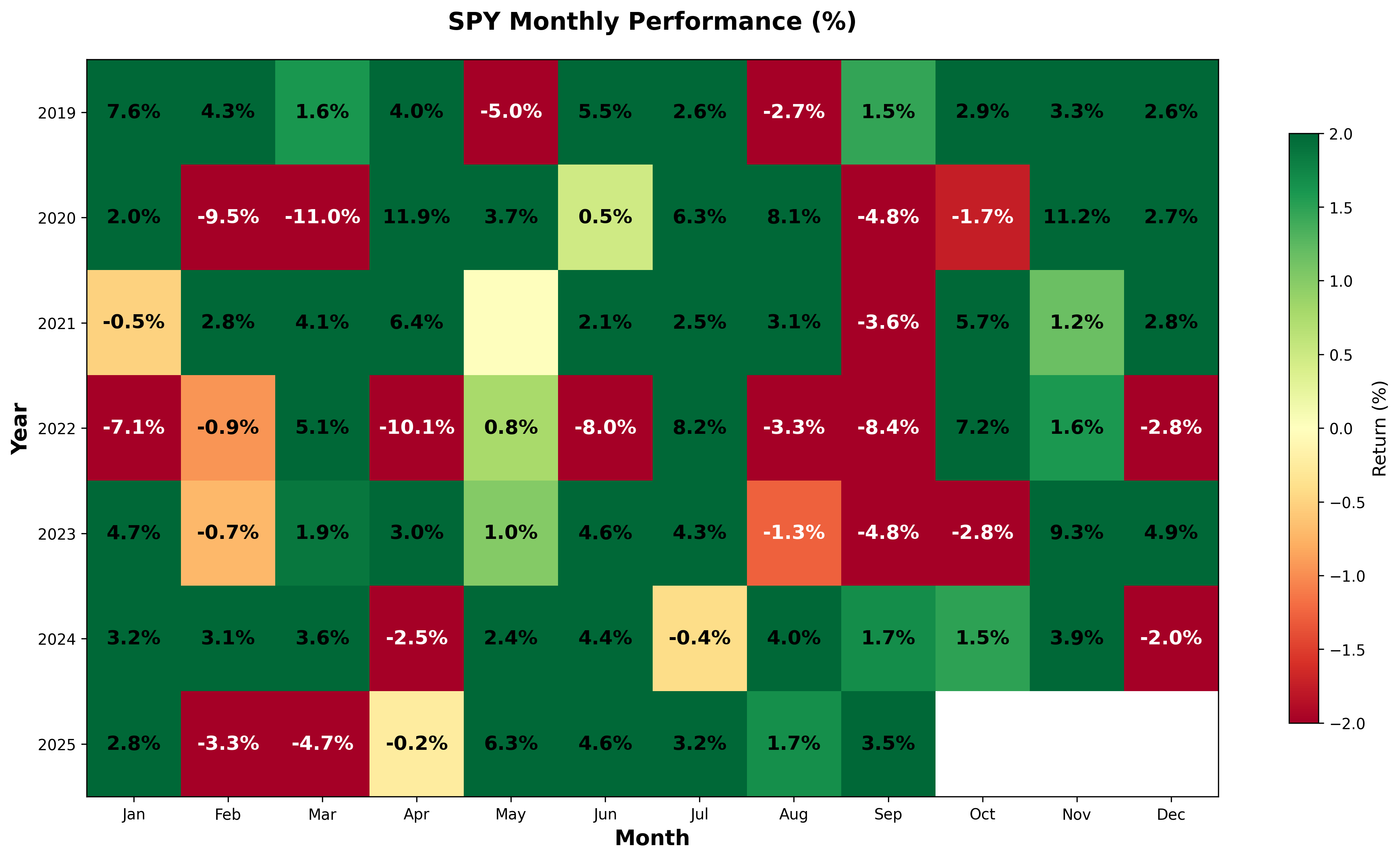

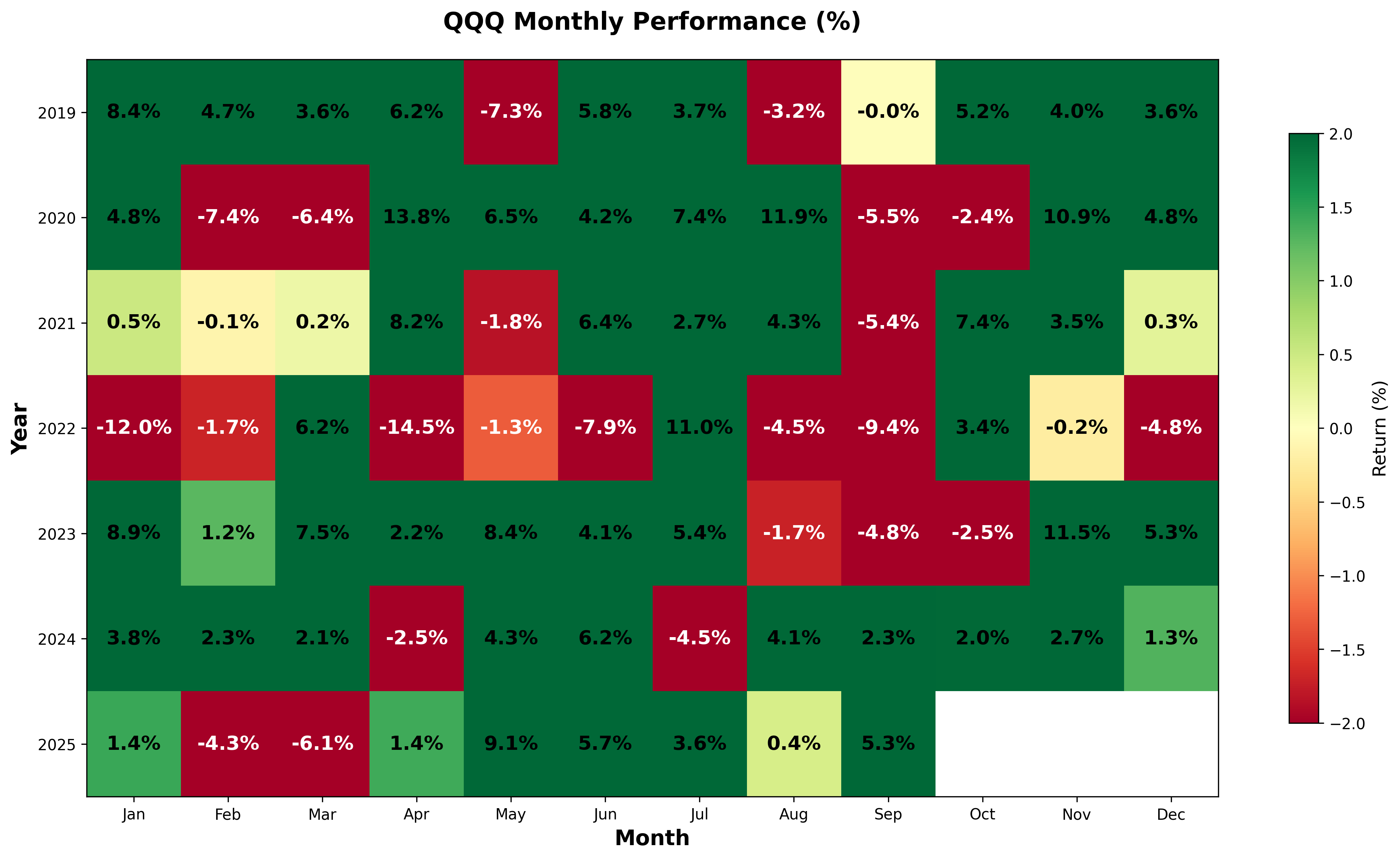

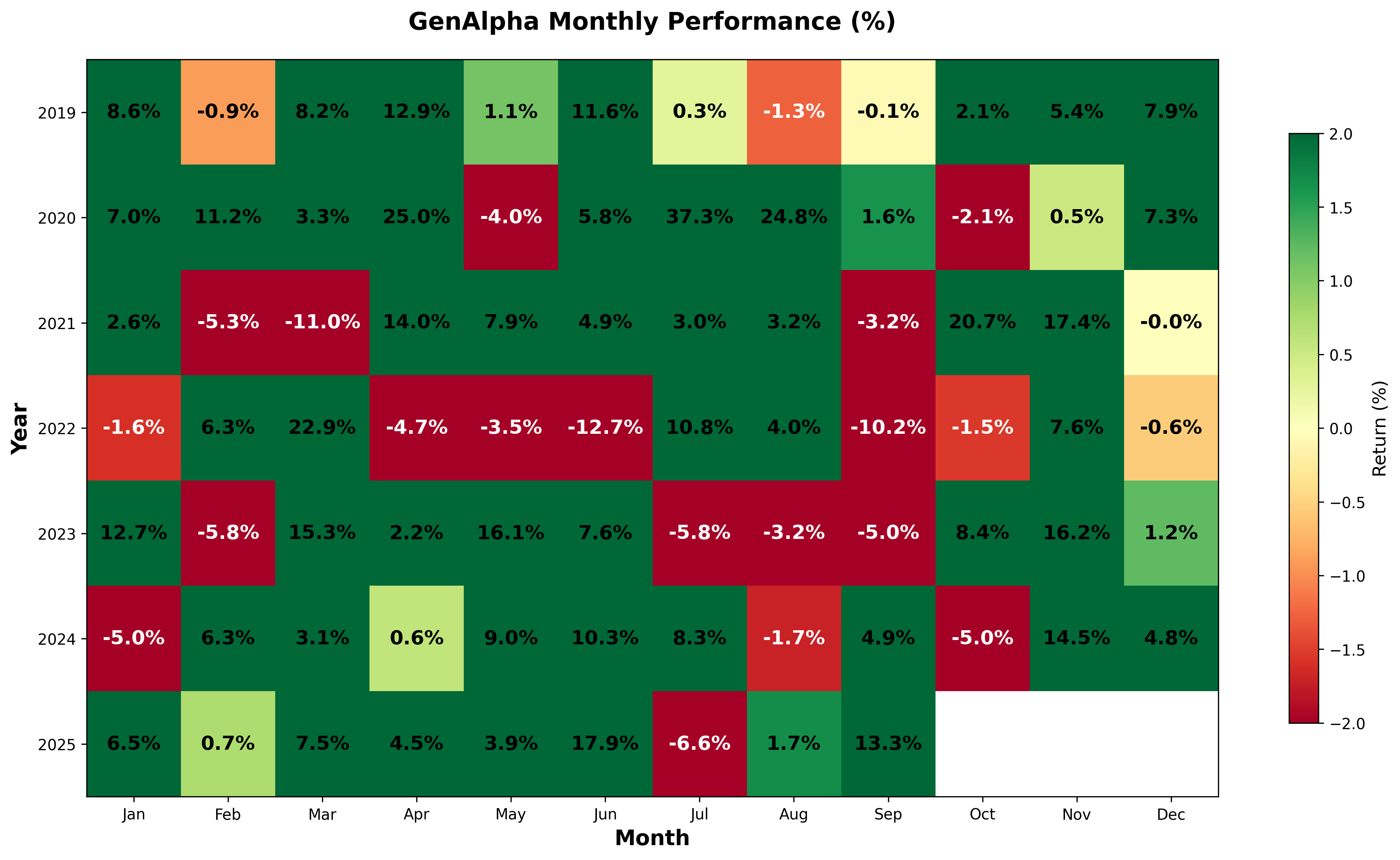

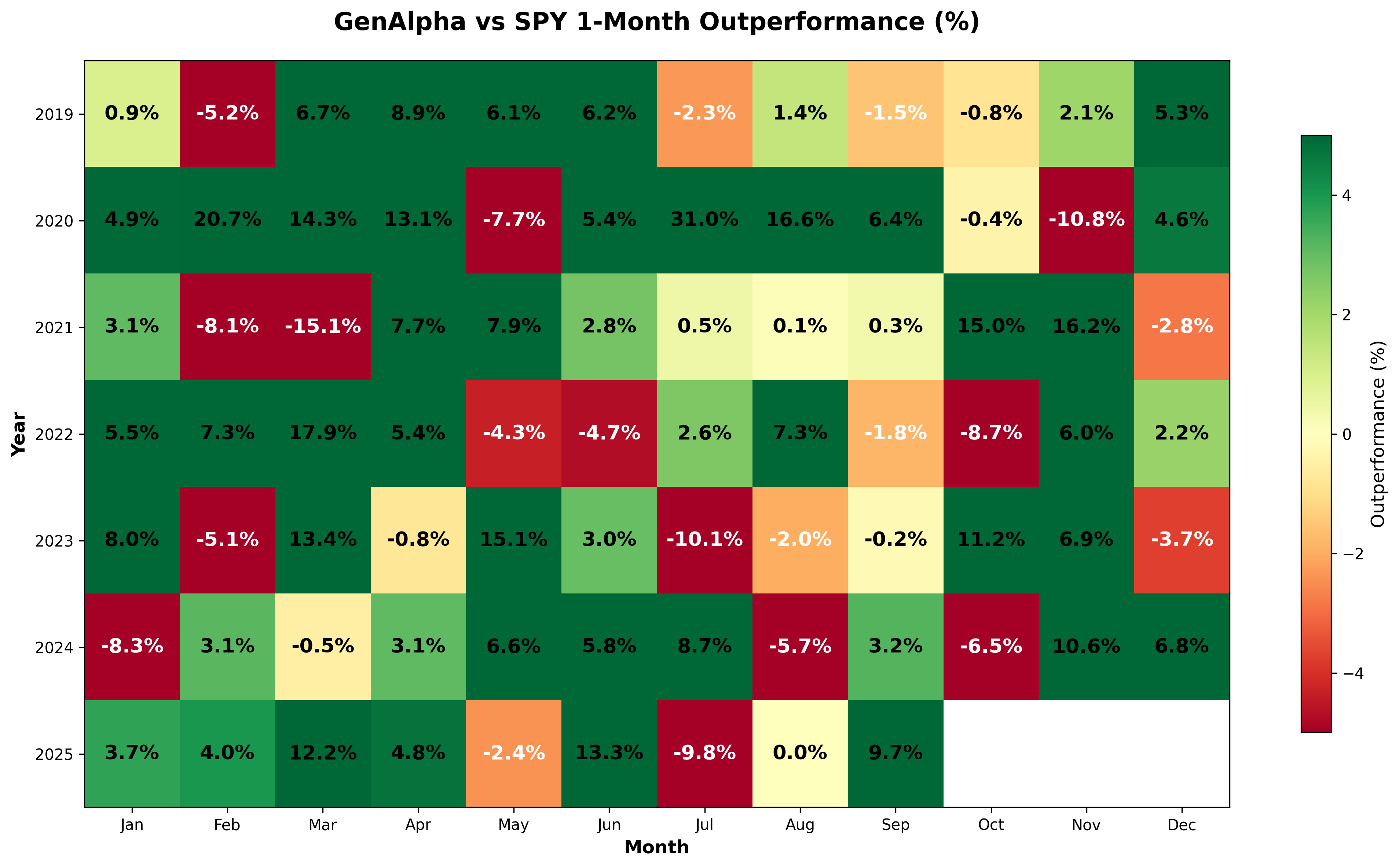

GenAlpha - 1-Month Performance Analysis

Click on the individual image to enlarge

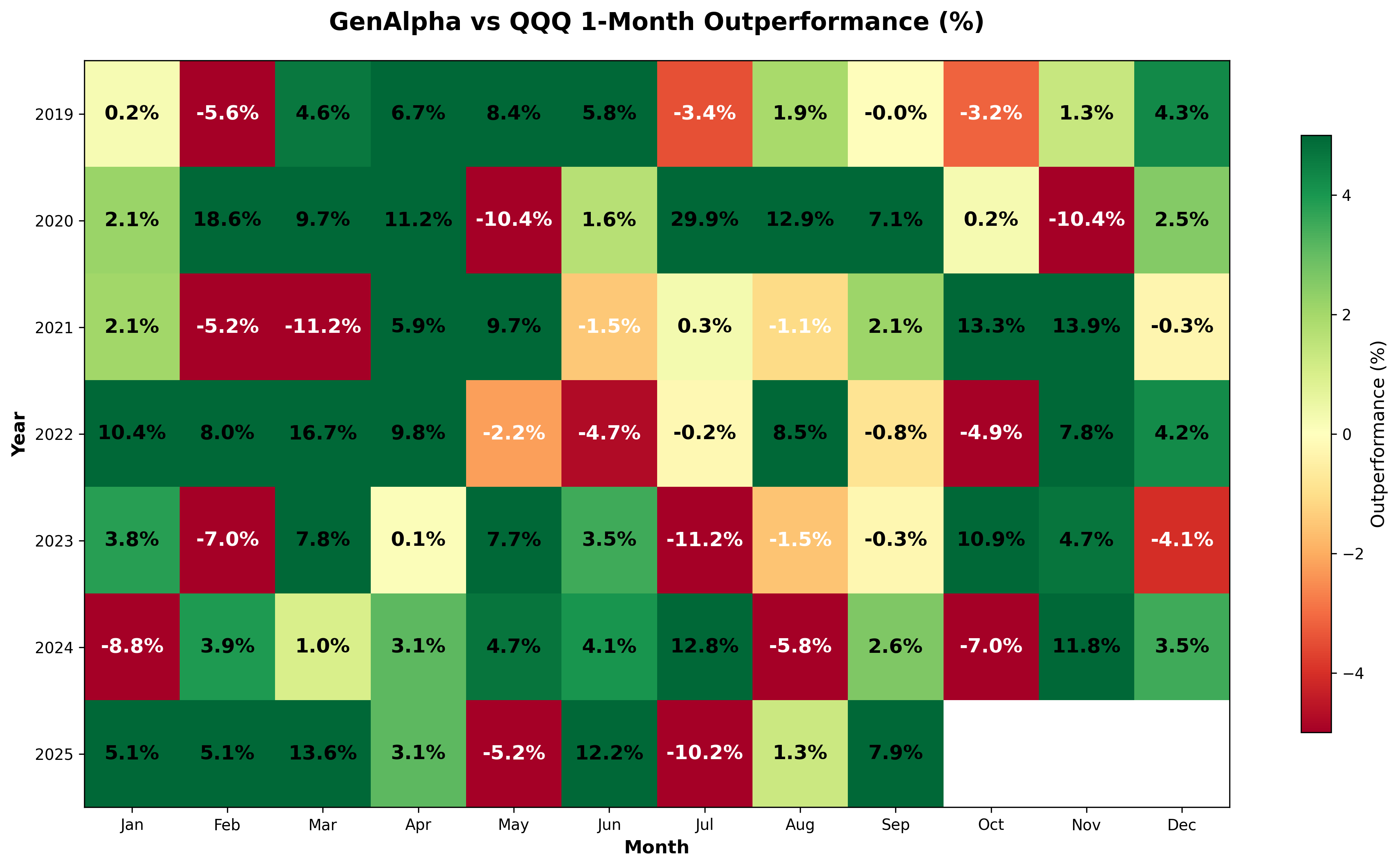

How to Read These Charts: The individual portfolio charts show monthly returns for each strategy. The comparison charts (GenAlpha vs Other Portfolio) display the difference in percentage returns between GenAlpha and the other portfolio. A positive number indicates GenAlpha performed better, while a negative number indicates the other portfolio performed better.

SPY

QQQ

GenAlpha

GenAlpha vs SPY

GenAlpha vs QQQ

*2025 performance is hypothetical YTD as of September 30th, 2025. Past performance does not guarantee future results.

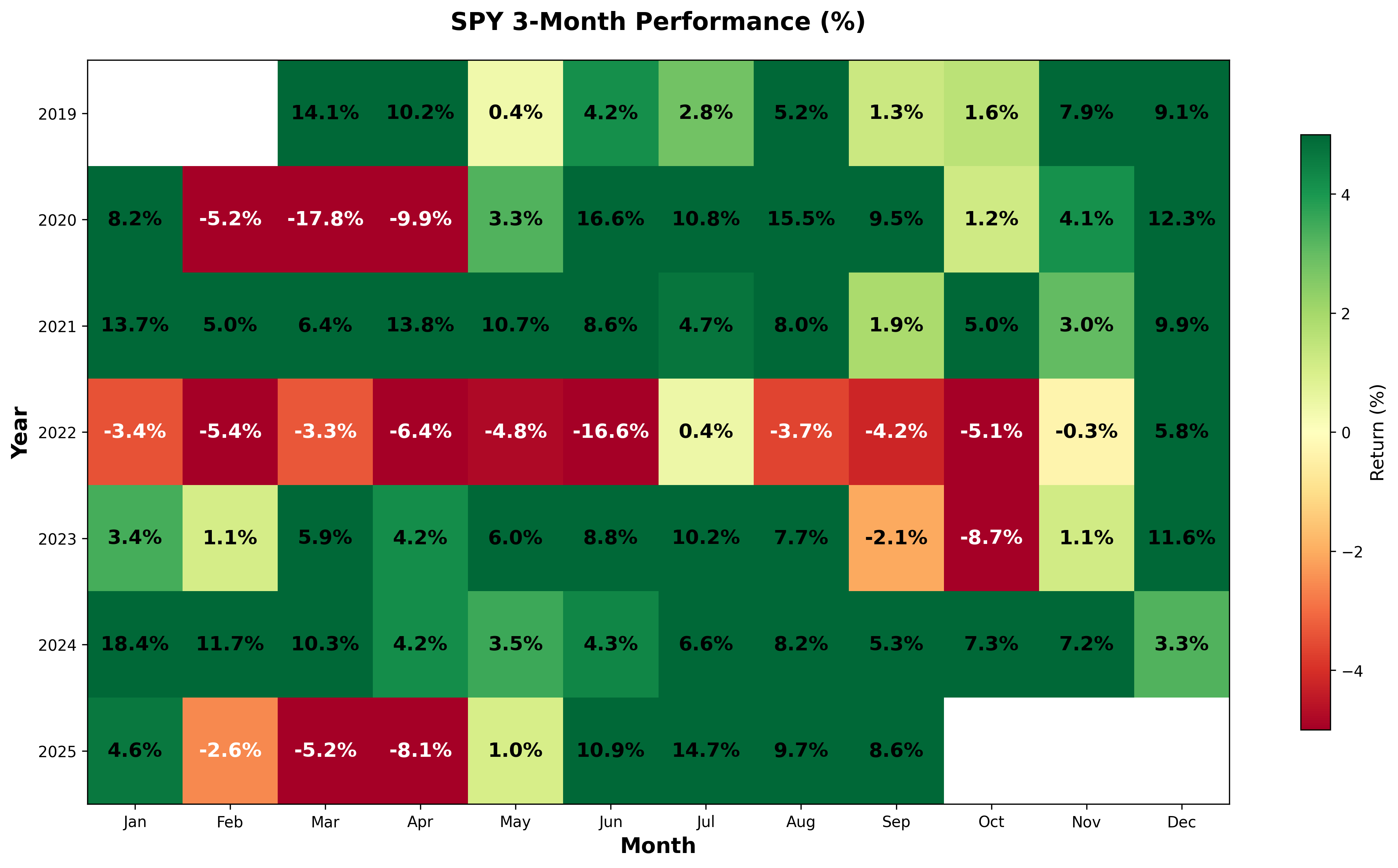

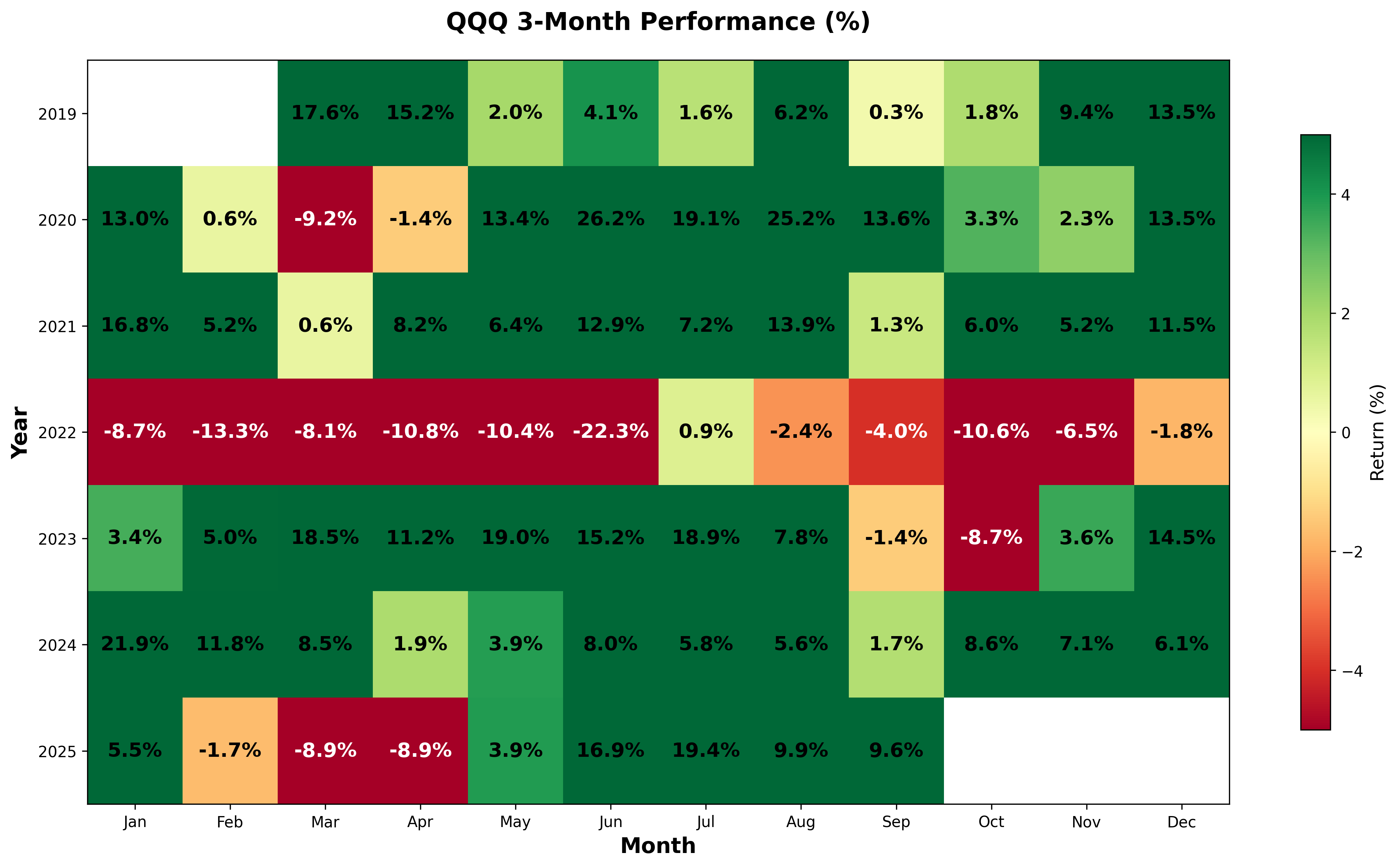

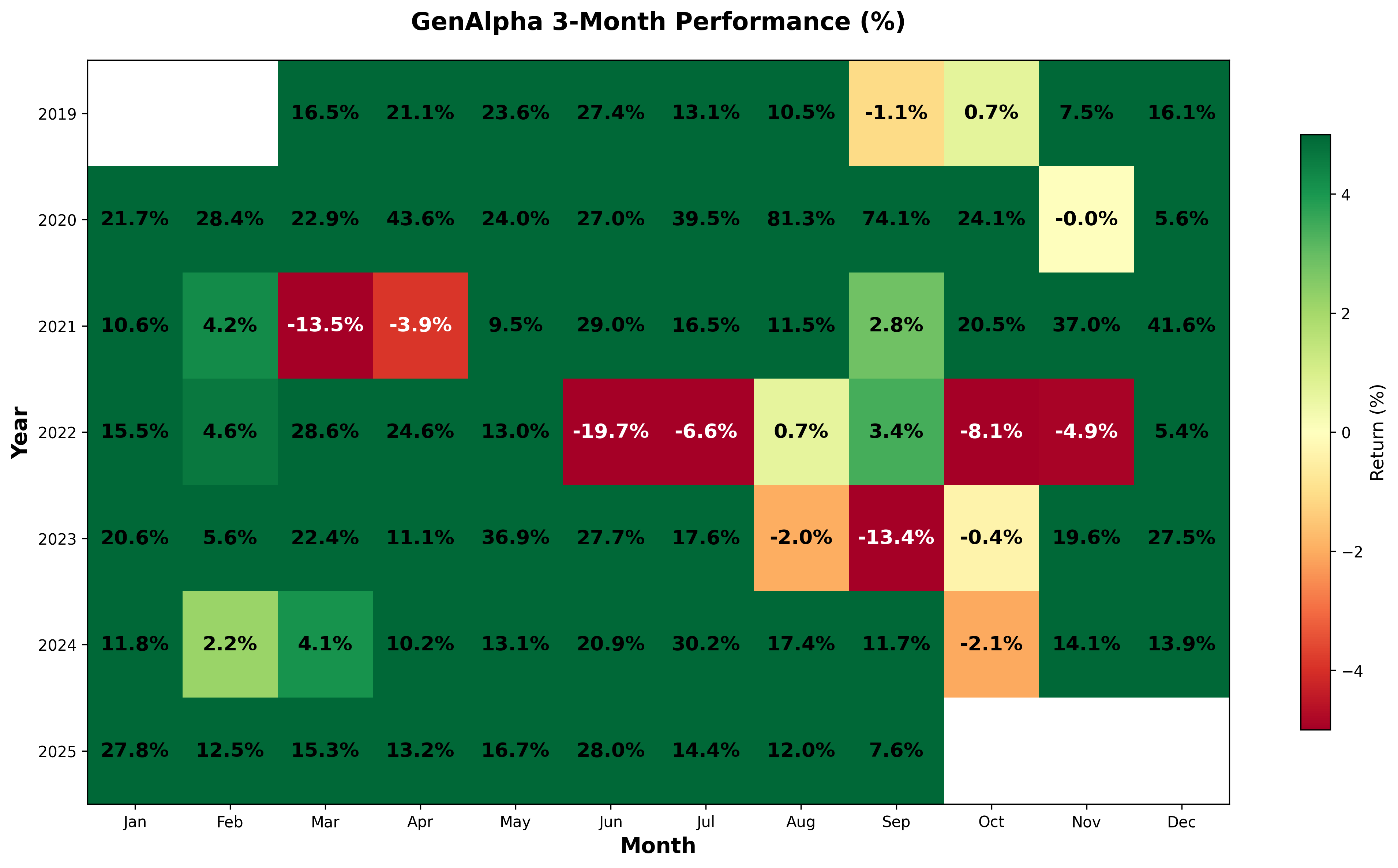

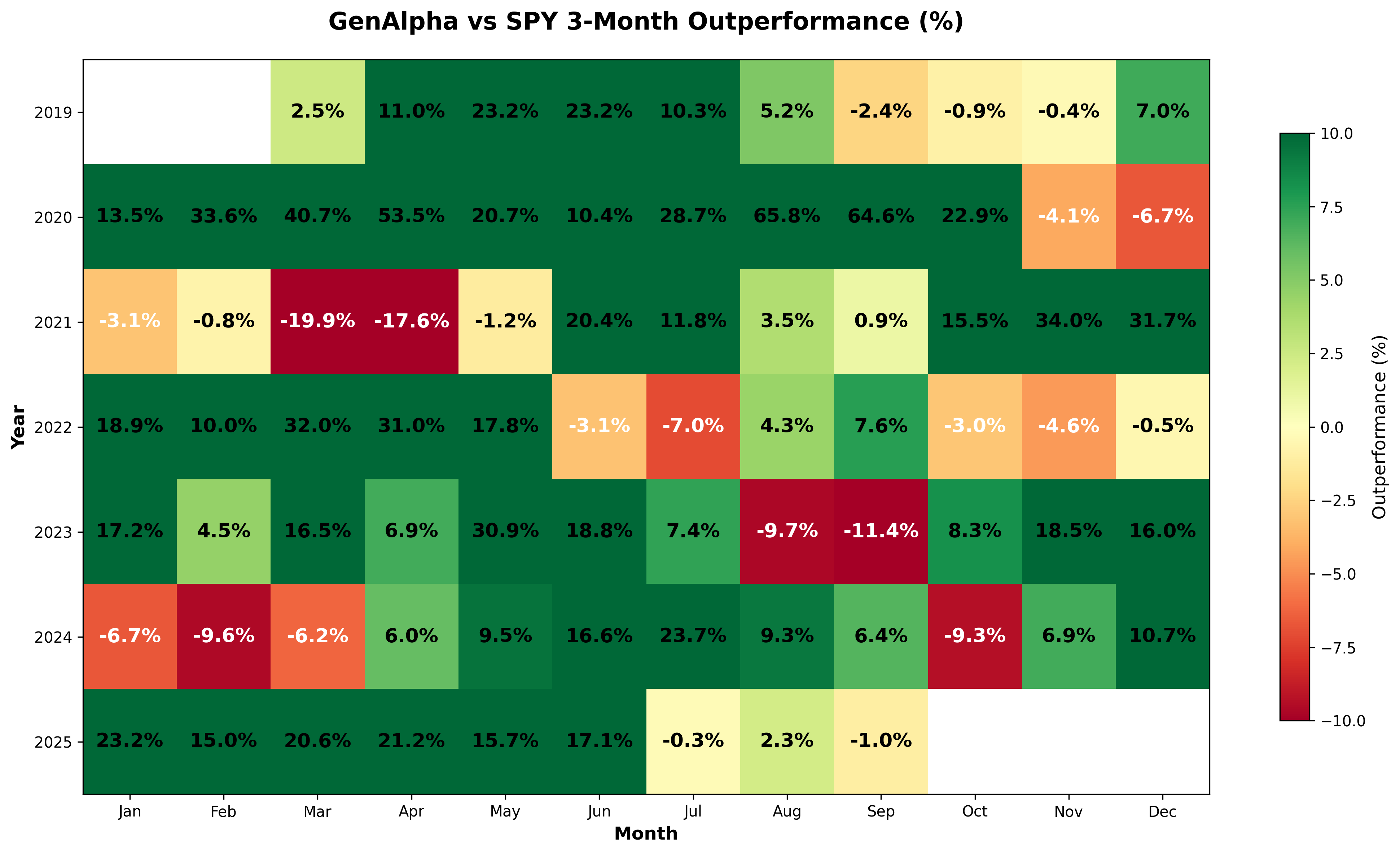

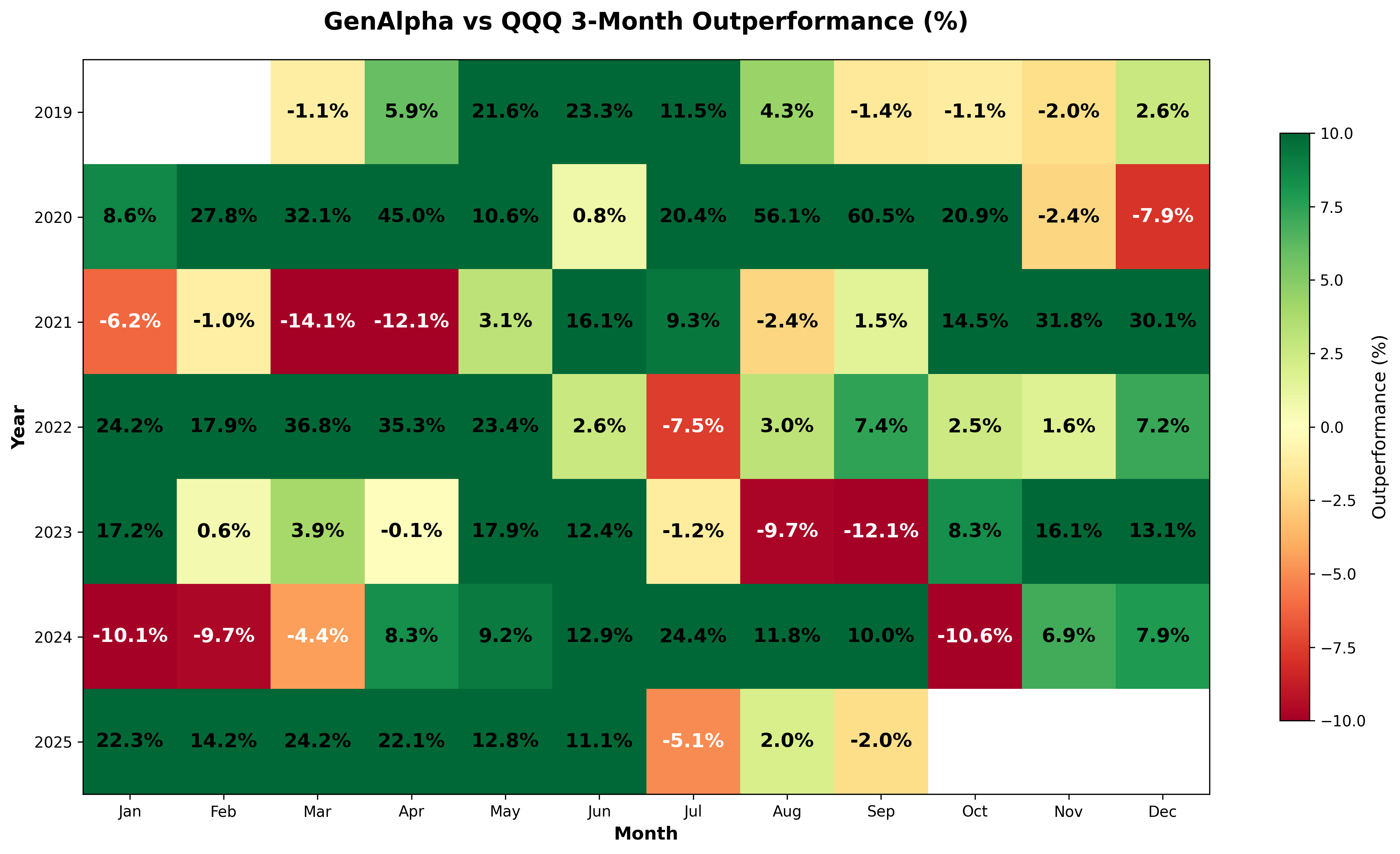

GenAlpha - 3-Month Performance Analysis

Click on the individual image to enlarge

How to Read These Charts: The individual portfolio charts show 3-month returns for each strategy. The comparison charts (GenAlpha vs Other Portfolio) display the difference in percentage returns between GenAlpha and the other portfolio. A positive number indicates GenAlpha performed better, while a negative number indicates the other portfolio performed better.

SPY

QQQ

GenAlpha

GenAlpha vs SPY

GenAlpha vs QQQ

*2025 performance is hypothetical YTD as of September 30th, 2025. Past performance does not guarantee future results.

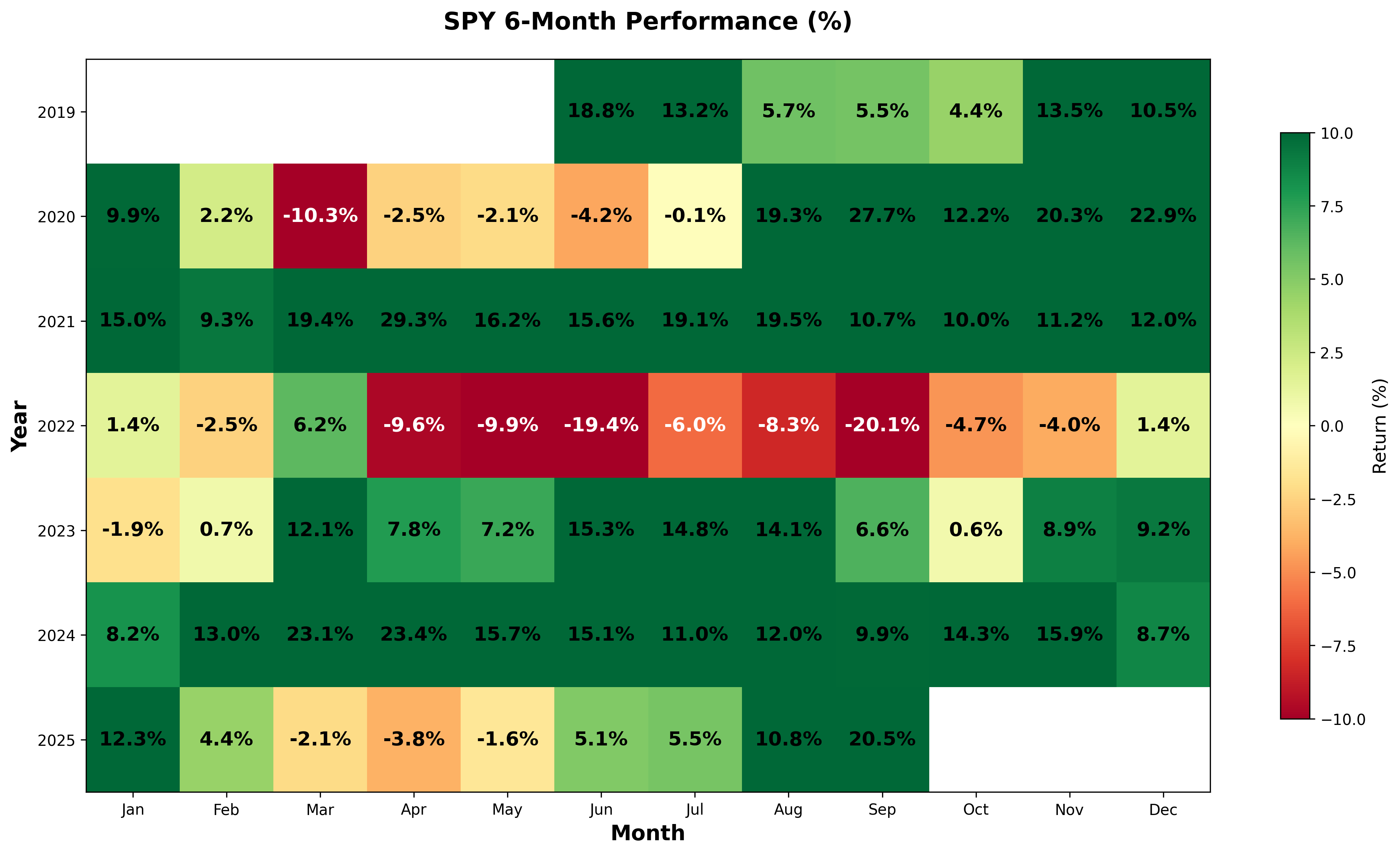

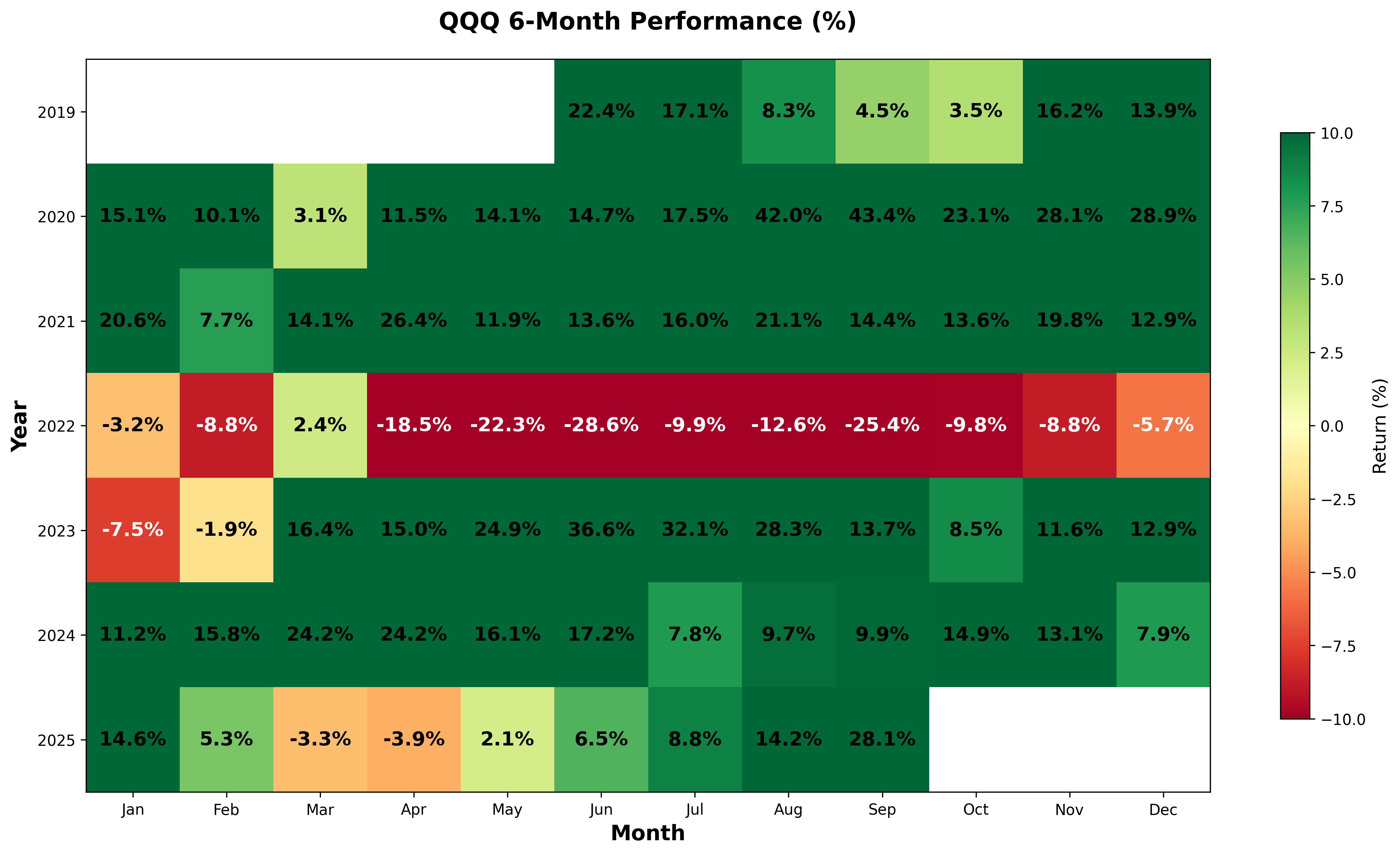

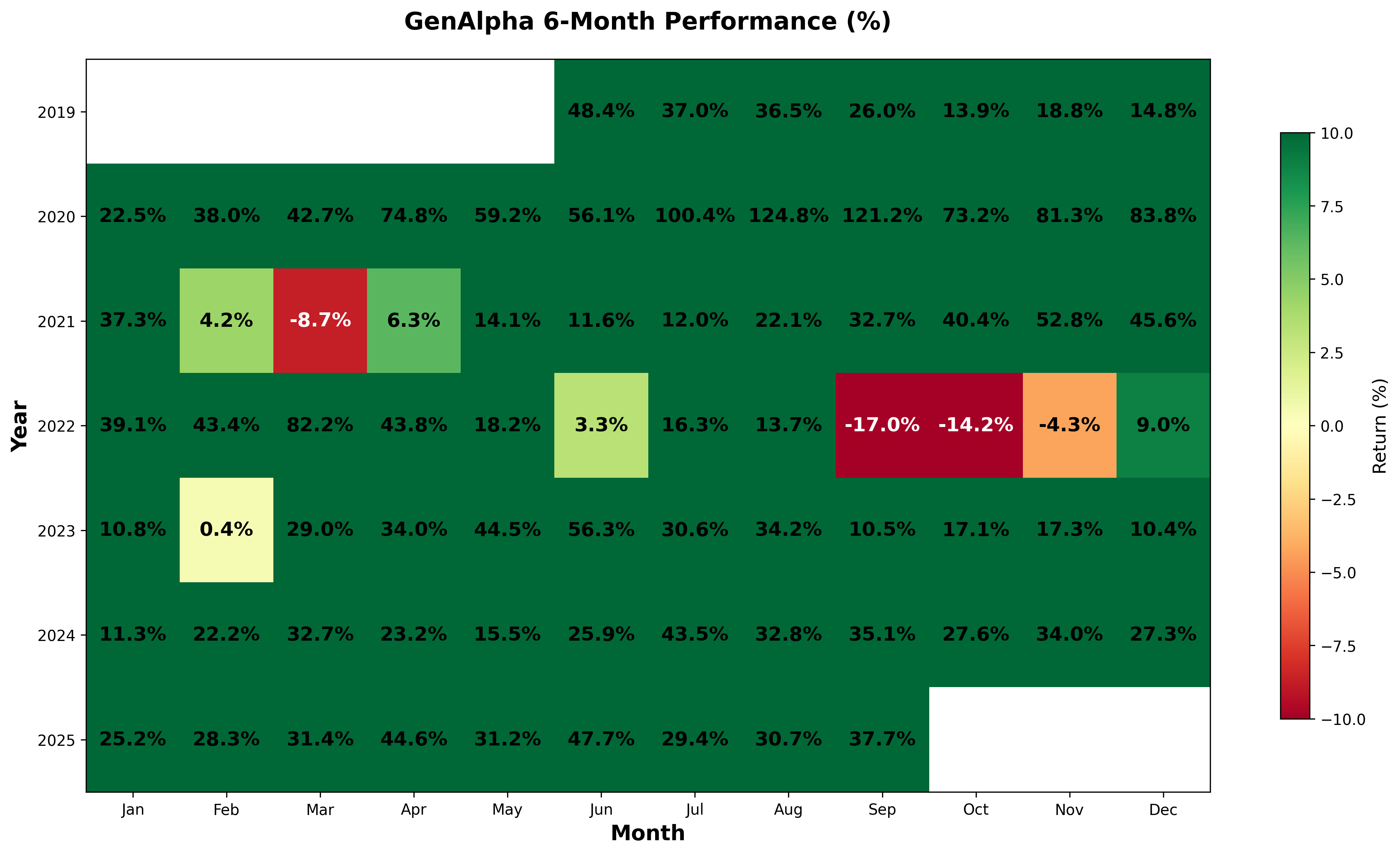

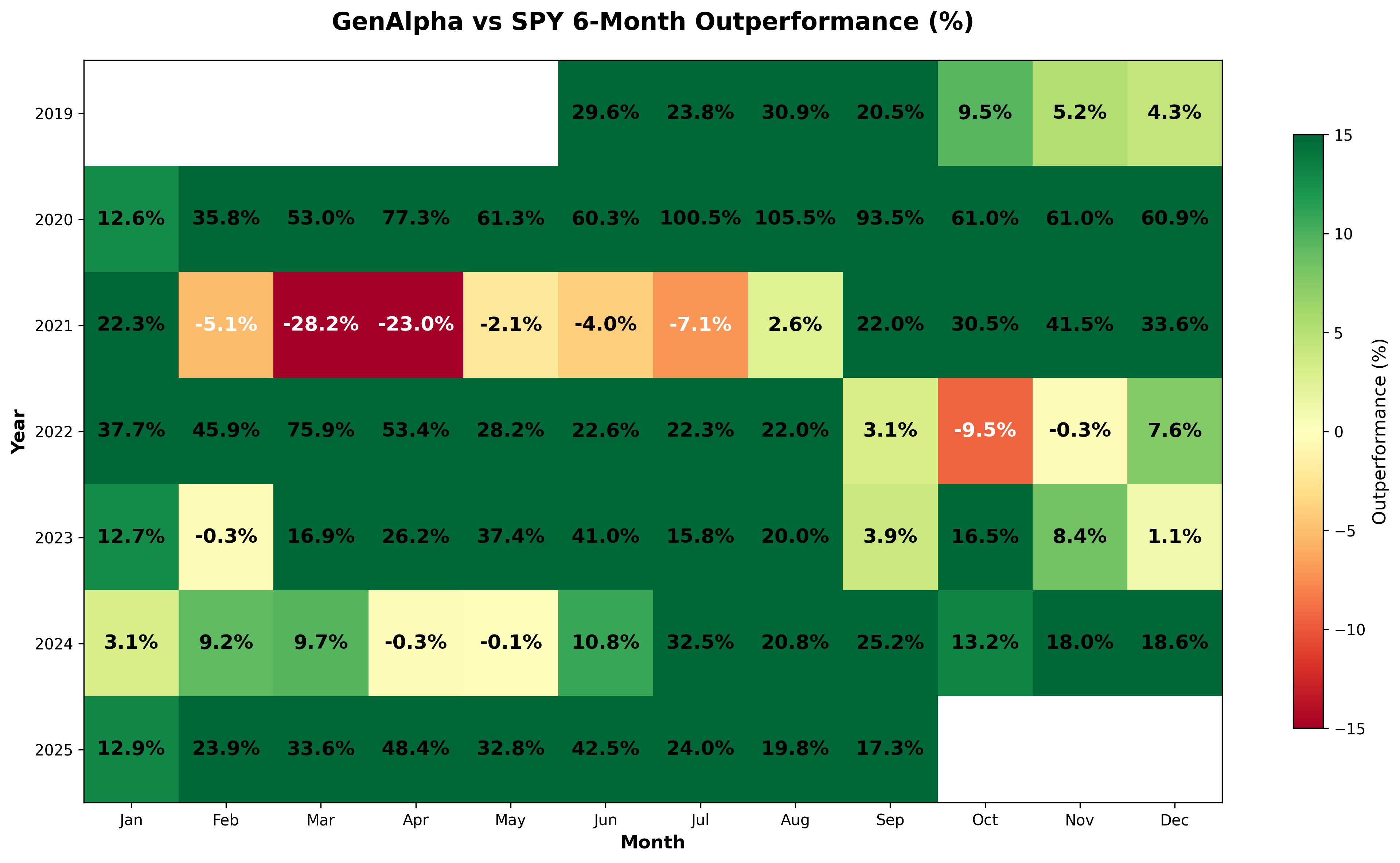

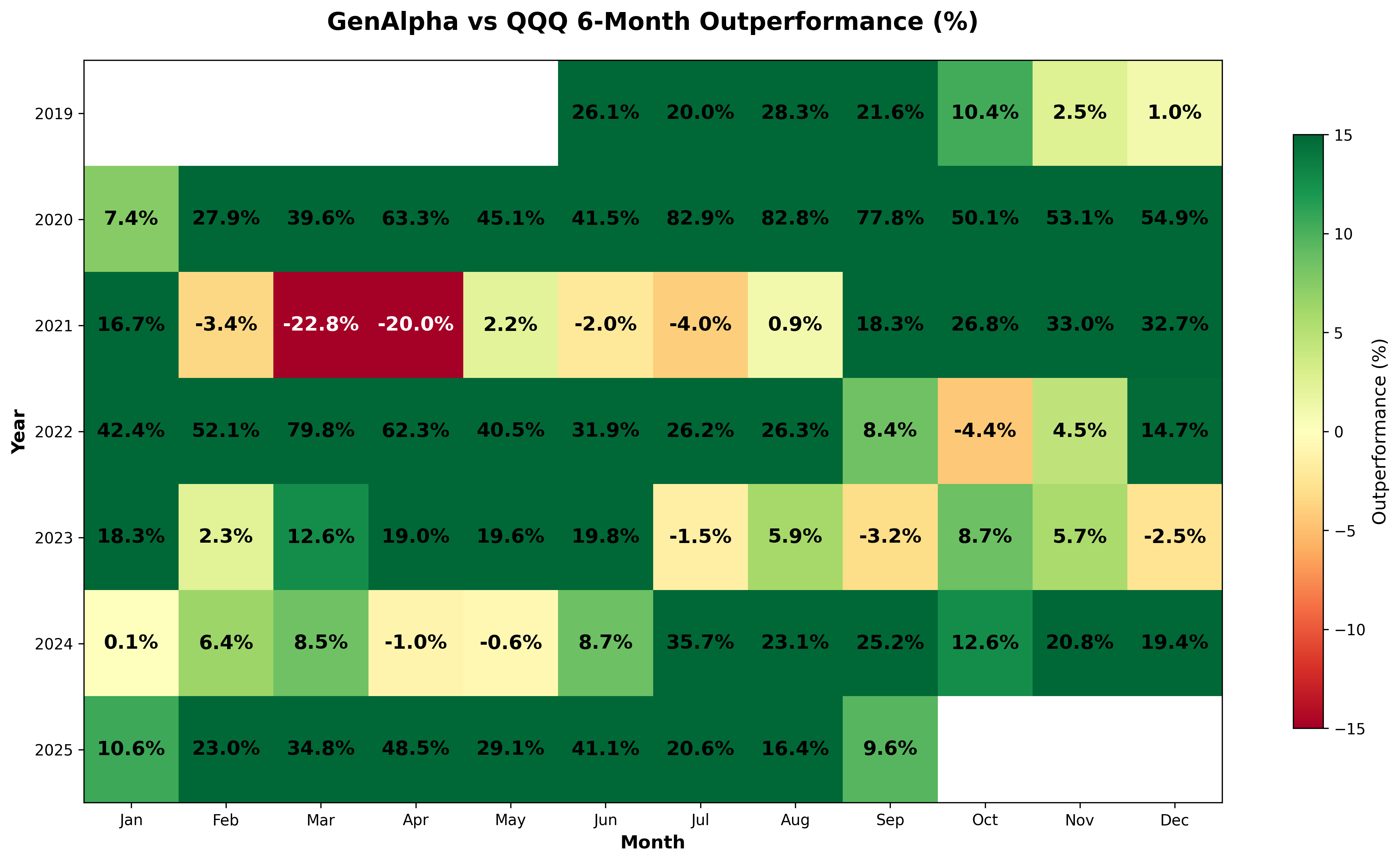

GenAlpha - 6-Month Performance Analysis

Click on the individual image to enlarge

How to Read These Charts: The individual portfolio charts show 6-month returns for each strategy. The comparison charts (GenAlpha vs Other Portfolio) display the difference in percentage returns between GenAlpha and the other portfolio. A positive number indicates GenAlpha performed better, while a negative number indicates the other portfolio performed better.

SPY

QQQ

GenAlpha

GenAlpha vs SPY

GenAlpha vs QQQ

*2025 performance is hypothetical YTD as of September 30th, 2025. Past performance does not guarantee future results.

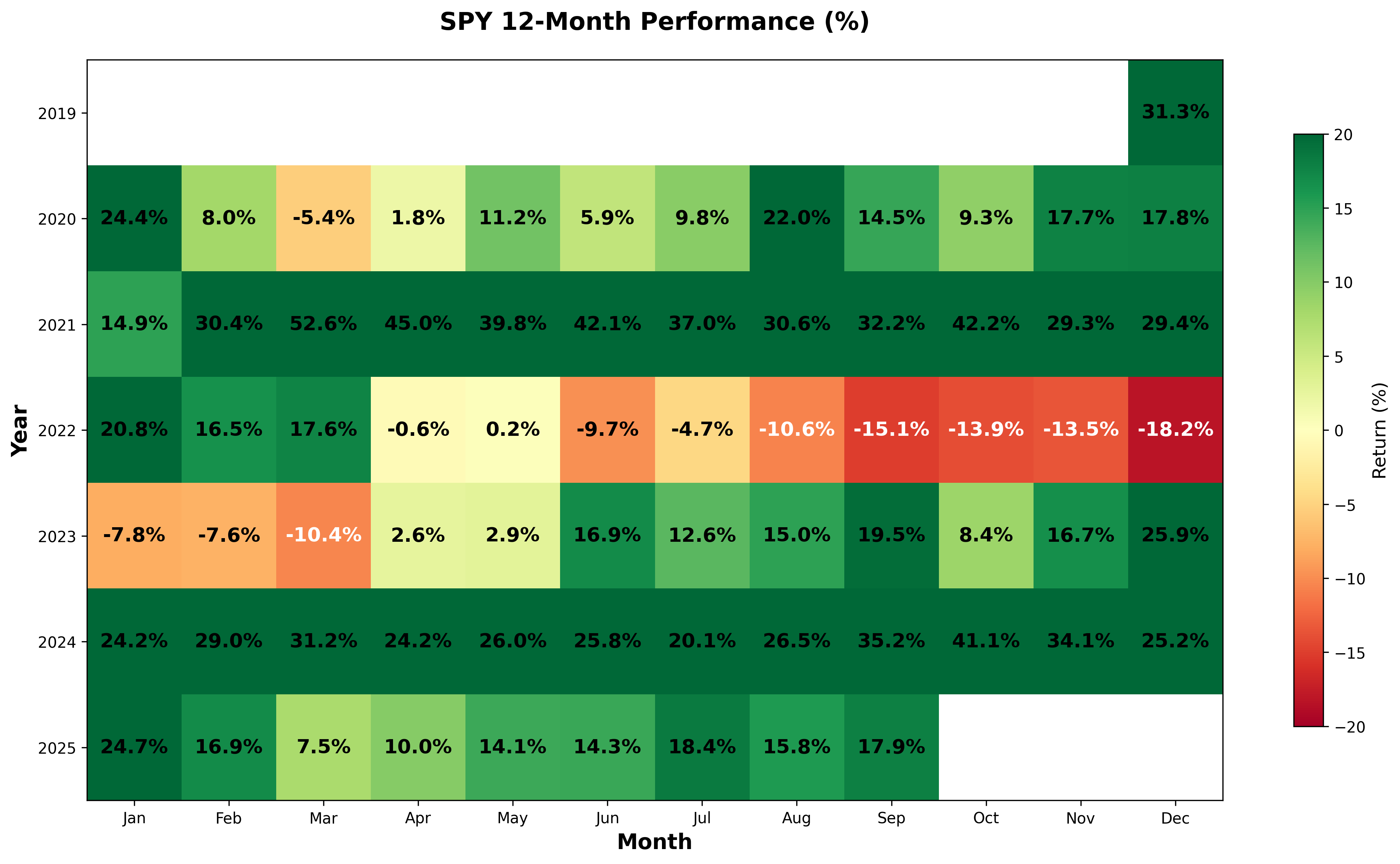

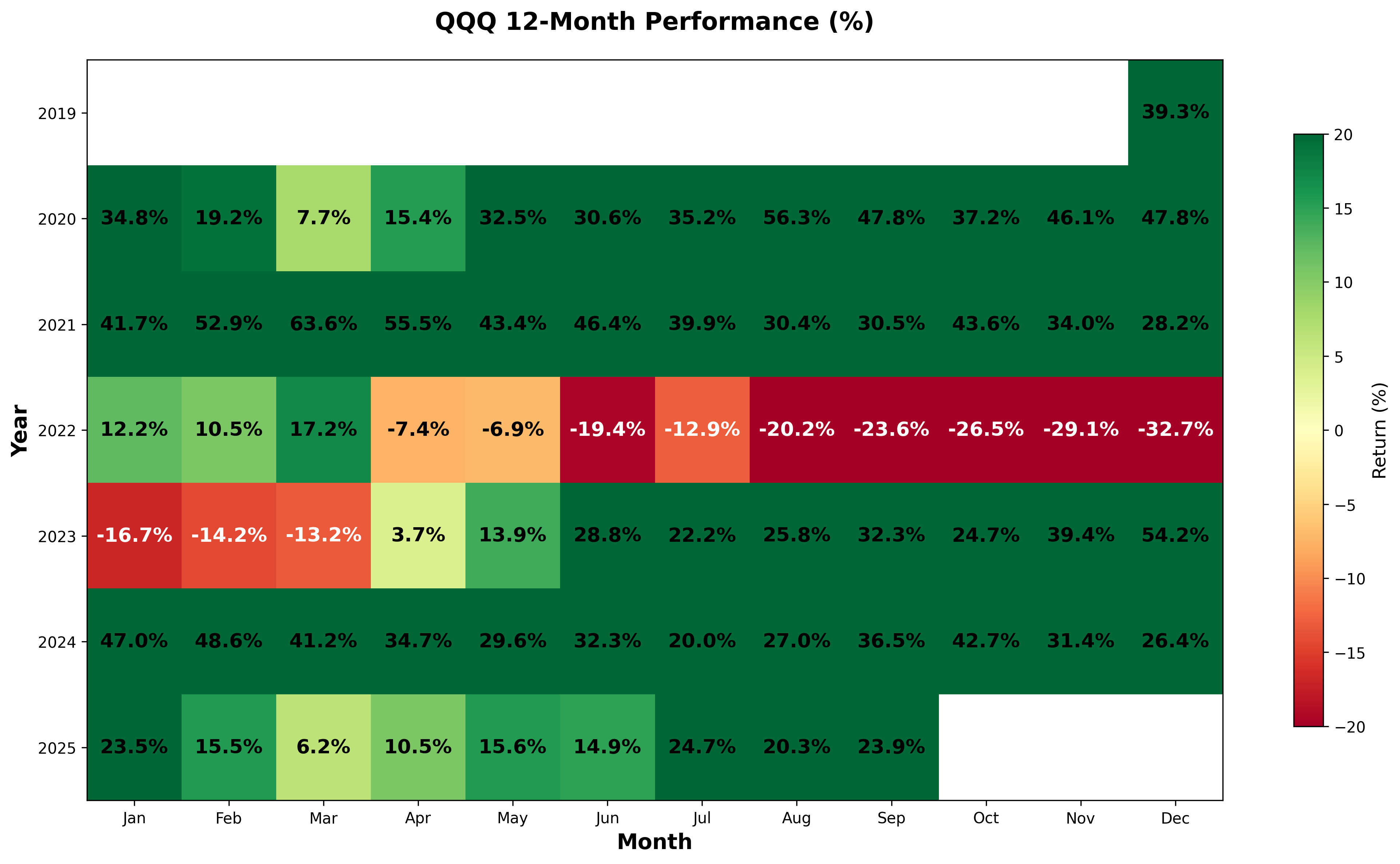

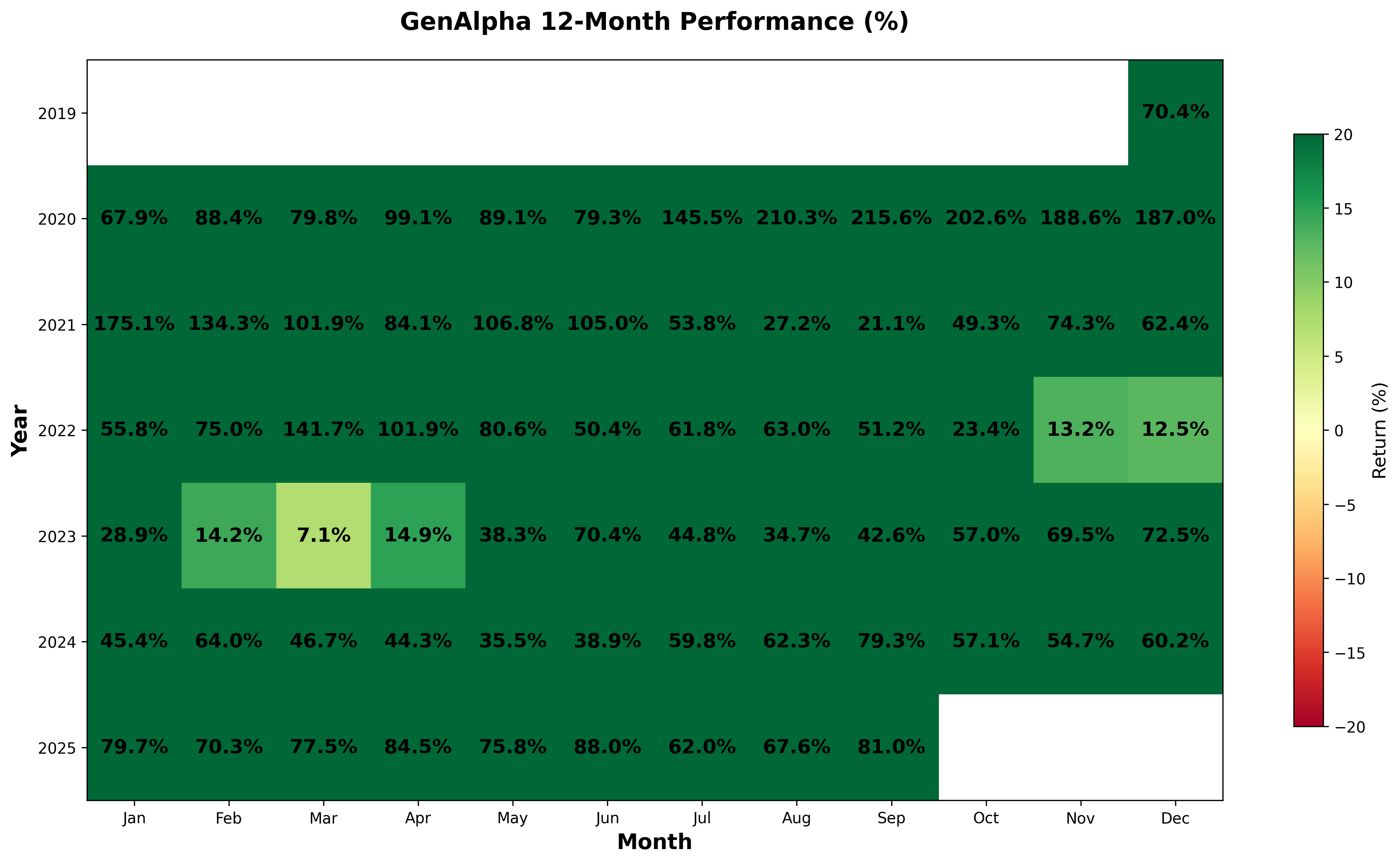

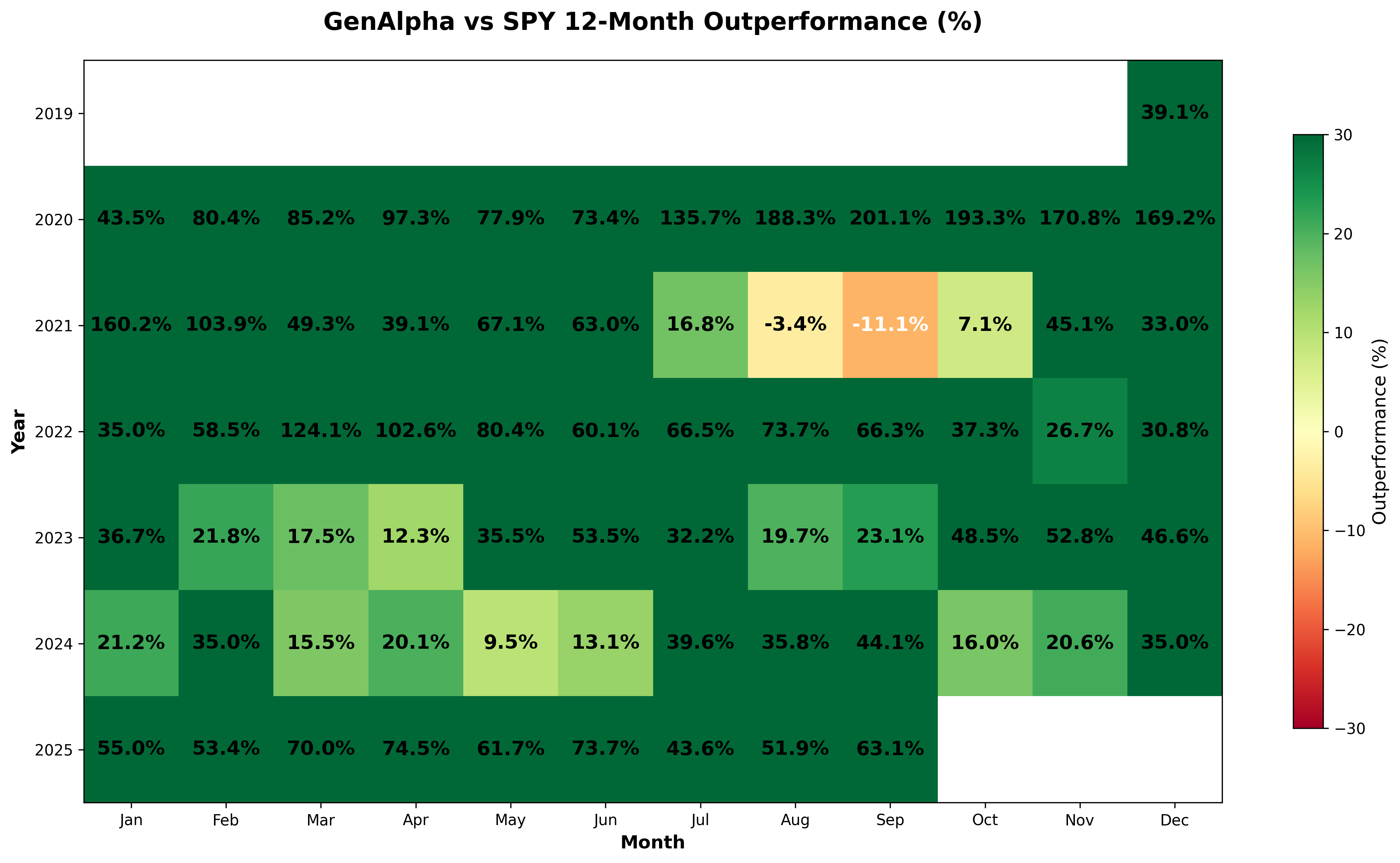

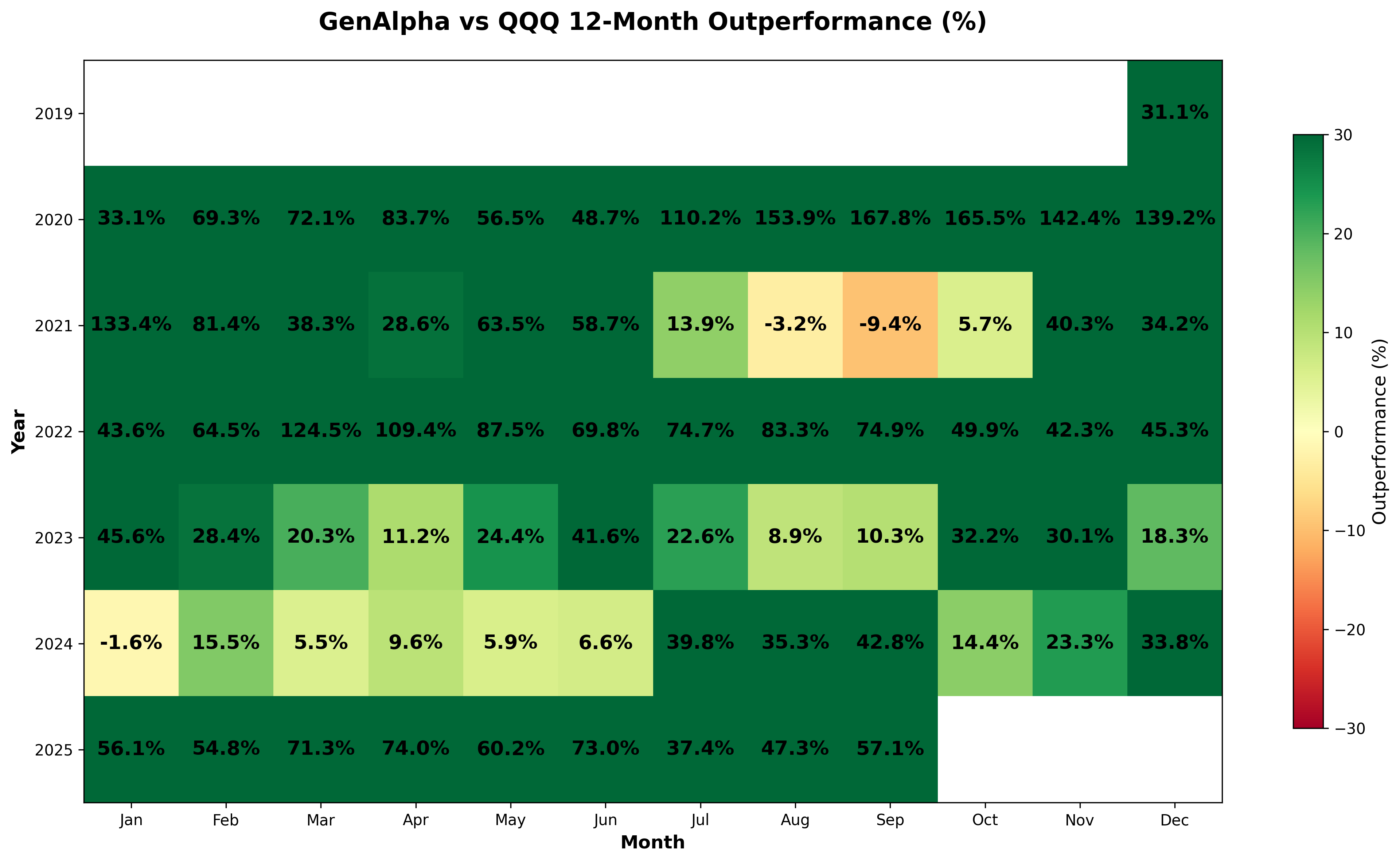

GenAlpha - 12-Month Performance Analysis

Click on the individual image to enlarge

How to Read These Charts: The individual portfolio charts show 12-month returns for each strategy. The comparison charts (GenAlpha vs Other Portfolio) display the difference in percentage returns between GenAlpha and the other portfolio. A positive number indicates GenAlpha performed better, while a negative number indicates the other portfolio performed better.

SPY

QQQ

GenAlpha

GenAlpha vs SPY

GenAlpha vs QQQ

*2025 performance is hypothetical YTD as of September 30th, 2025. Past performance does not guarantee future results.

Ready to Take the Next Step?

Start your algorithmic trading journey with our proven GenAlpha signals to achieve your financial goals.